Payment applications are transforming the process of making payments. With digitalization, cashless transactions have become more common, and the demand for payment apps has increased. Online payment is now a global cultural norm, and paying cash has massively reduced.

It has made people’s lives a lot easier, so they are inclining more towards cashless payments. Investing in a payment app for small businesses can provide great profits. The need for payment apps will always be there as these apps eliminate the necessity for going to an ATM every time to withdraw money.

From grocery shopping to booking online tickets, everywhere payment apps are used nowadays. Payment apps are helpful for online purchases and are also used for in-store purchases as cardless and cashless transactions are becoming popular. By reading further, you will learn how to build payment apps and the features to include in a payment app. But first, understand the workings of payment apps.

How Do Payment Apps Work?

Payment apps are a service for performing electronic transactions, and users can transfer money through these apps. Users pay each other via their linked cards and bank accounts. When a user sends the card details to a payment gateway, that gateway sends all the information to its linked bank, and the request initiates.

The payment system then analyses the amount of money, and the bank sends a code of authorization to complete that payment. After that, the gateway accepts the code and the user’s bank allows the transaction where another person’s bank account receives the money. This complete process happens in just a few seconds which makes transactions a lot easier.

Check out: PayAngel – Money Transfer App Development Solution

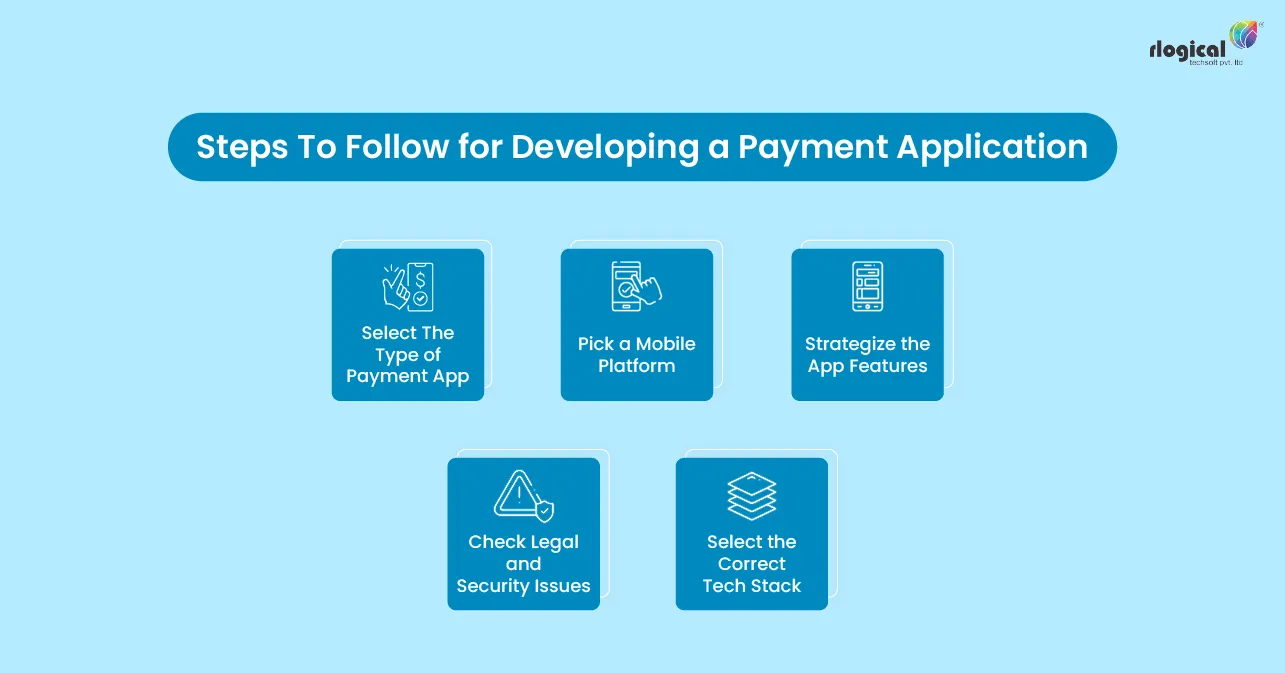

Steps To Follow for Developing a Payment Application

1. Select The Type of Payment Application

There are several types of payment applications from which you have to decide the application type you want to opt for. The choices are standalone apps, social media-centric apps, foreign exchange apps, and bank-centric apps. The standalone payment applications offer quicker transactions, and these have an offline wallet. In the social media-centric app, transactions can be done through social media platforms. Foreign exchange apps are useful for overseas transactions, and bank-centric apps are payment gateways where one bank remains an acting party.

2. Pick a Mobile Platform

If you have less budget, ask your payment app development company to build a mobile payment app. Two popular mobile platforms are Android and iOS. You can start with one platform, and then after some time, you can go for app development for another platform.

3. Strategize the App Features

There are certain essential features that a payment app should include. You can also add some additional functionalities to make the app more unique. Furthermore, everything relies on your set of requirements. A payment app should have basic features: signup or login page, authentication, push-up notifications, digital wallet, unique ID, OTP verification, chat functionality, bill and invoice facility, transaction history, and sending, and receiving money.

4. Check Legal and Security Issues

It is an imperative step, and you have to fix all security problems to secure that application and build trust among users. You also need to abide by the legal rules for creating an app and launching it successfully into the market. By including security lock or touch ID features, you can secure the app. You can include two-factor authentication as well to provide added security. Instant notifications about transactions can also elevate the app’s functionality. Check out the regulations and security standards of payment gateways to know what you have to follow.

5. Select the Correct Tech Stack

The tech stack largely depends on whether you choose a web, hybrid, or native-type app. For creating a payment app for small businesses, you should select a technology stack that provides great results at less cost. Free and open-source platforms can be an excellent option. Also, pick one mobile platform, either iOS or Android and select tools according to that. You will need tools for notifications, digital wallets, sending invoices and bills, creating OTP verification and ID, and transactions.

Also Read: How to Build a Money Transfer App?

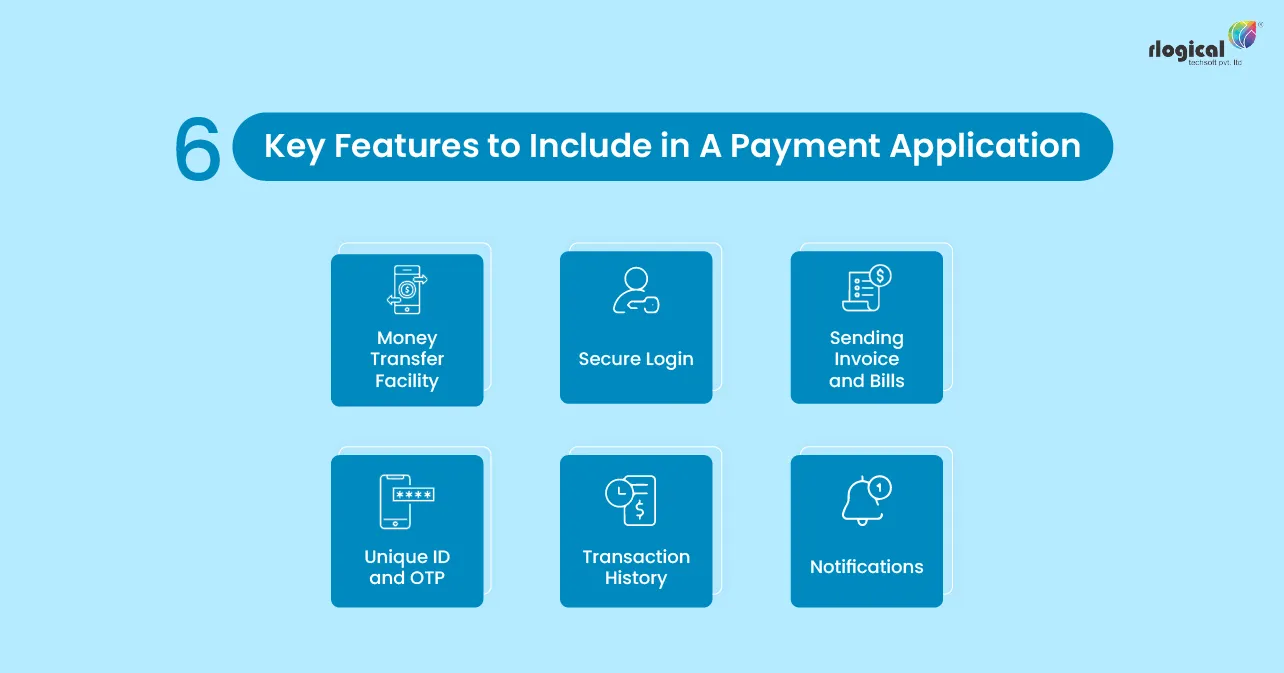

Key Features to Include in A Payment Application

For creating a good payment application, you should include some critical features that can make the application successful. Such features are listed in the following that can help you stand out from the competition.

1. Money Transfer Facility

Transferring money is essential for payment apps, and your application should integrate with users’ contacts to make payments quicker. It should also include a search bar to search for recipients easily. Moreover, users should also be able to provide money to unregistered users.

2. Secure Login

With the help of a payment app development company, you can get an app with email login, and biometric authentication like facial recognition and fingerprint unlock. Multi-factor authentication is best for payment apps.

3. Sending Invoices and Bills

The app should generate invoices after each transaction, and both user sides should receive the invoice. It is the proof of their transaction. Moreover, users should also be allowed to share payment invoices through the application.

4. Unique ID and OTP

All payment solutions should include the feature for creating a unique ID and one-time password so that users can verify themselves before doing transactions. It increases the payment app security every time the users make transactions.

5. Transaction History

It is an important feature that enables users to view their payment summary in the past made through the application.

6. Notifications

This feature has utmost importance as it notifies users when a payment request is started or received.

There are also some other features like a chatbot and messaging facility that allow users to ask queries about the app and get all answers.

Complete Expert Guide: How to Create Mobile Banking App

Wrapping Up

People are shifting more and more towards digital payment systems, and there is an immense demand for payment apps. Through the steps mentioned above, a payment app can be created. But you should also focus on features as these are something that can elevate the experience of users. So, analyze and prioritize everything you want in your payment app and include features that make the app successful.

Jatin Panchal

Jatin Panchal is Founder & Managing Director of Rlogical Techsoft Pvt. Ltd, a custom web & mobile app development company specialized in Outsourcing Web Development Services, Android, iOS and IoT App development.

Related Blog

Categories

- All

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Get in Touch

Contact Us

3728 N Fratney St Suite 213, Milwaukee, WI 53212, United States

Sales Executive: +1 414 253 3132

Contact Email: [email protected]

701 & 801 Satkar Complex, Opp Tanishq Showroom,Behind Lal Bungalow, Chimanlal Girdharlal Rd, Ahmedabad, Gujarat 380009

Rahul Panchal: +91-9824601707

Jatin Panchal: +91-9974202036

Contact Email: [email protected]

301 1-28-21 Hayabuchi, Tsuzuki-ku, Yokohama-shi, Kanagawa 224-0025, Japan

Contact Email: [email protected]

Jatin Panchal in Money Transfer App Development

Jatin Panchal in Money Transfer App Development