|

Getting your Trinity Audio player ready...

|

Blog Synopsis: Over the past few years, Chime has grown enormously. Establishing a mobile app like Chime is a challenging task though. You have to examine and work on minute details of each aspect. This article is an in-depth view of creating mobile banking apps like Chime. For startups or banking firms, we have elaborated on the advantages and budget-friendly procedures.

Have you heard about the Chime app? If not, then you might be living without internet or banking updates. The Chime banking app is the most famous and biggest Neobank in the US. It has a 4.5-star rating on the Play Store and 4.8 on the Apple Store. Consequently, it has made its position static as the top mobile banking app in the United States.

By the end of 2025, Chime is anticipated to surpass a whopping 22.7 million account holders. Undoubtedly, Chime gives high-end competition and raises the bar in the banking sector. Nowadays, traditional banks should level up to build an app like Chime. Without having an online presence, your banking business won’t survive in the future.

Besides that, if you want to enter the market with a fresh banking app like Chime. You are at the right place. Continue reading to know how you can make an app like Chime. Let’s begin with the basics.

What are Mobile Banking Apps like Chime?

A mobile banking app is a software-oriented banking solution. It permits users to oversee their banking needs through online platforms. Moreover, mobile banking applications are a thriving solution these days. It has empowered banking operations.

From opening your bank account to maintaining multiple banking functions, it’s a matter of clicks now. Hence, you can manage it on your mobile phone. It ensures handling A-Z banking tasks through a single application.

Online banking apps like Chime give you the privilege to control financial transactions. Therefore, you can pay your bills, manage fund transfers, investment plans, etc. Ultimately, it offers you the comfort of accessing your banking accounts on your mobile devices. Regardless of your location and time zone, you can conduct banking transactions efficiently.

By leveraging mobile banking services, users can utilize the following solutions;

- Digital banking experience

- Personalized financial advisory services

- Access to various payment methods

- Auto-generates transaction reports

- Analyzes user’s expenditure graph

- Shows account balance on a real-time basis

- Prepares your financial statements

- Recommend ideal investment plans

- Maintain transparency

- Offer better security authentication

So, you can easily get valuable solutions at your fingertips. Such rewards are lacking in traditional offline banking operations. Besides that, the mobile banking app is segmented into various types. Keep reading to get a closer look at these types.

Types of New Mobile Banking Apps

Firstly, let me tell you that the term banking industry has evolved. Now, it has been denoted as the fintech sector. The major reason for this terminology is a combination of financial institutions with advanced technology. Moreover, the technology implies the mobile banking app. Here are the primary mobile banking types.

-

Neobanks

The Chime banking app is an example of Neobanks. It is the latest banking type. However, Neobank doesn’t have any physical branches. It is an online-only fintech enterprise. Yet it offers you all the traditional bank features.

But the catch is that Neobank charges low-to-no fees for banking operations. Thus, it is a more cost-effective banking application than traditional banks.

Related Guide: What is Neobank in the Fintech Industry?

-

Digital wallets or NFC

The utilization of digital wallets has been impressively enhanced. It offers the convenience of scanning and paying instantly. Basically, the Near Field Communication (NFC) enables you to perform contactless payments. In addition to that, NFC is incorporated into digital wallets. So, you can quickly manage your payments through mobile devices.

How Does Chime Earn Money?

After understanding the types of banks, let’s move to your main question now. It’s quite obvious to consider revenue sources to build an app like Chime. But for that, you need to have an insight into how Chime makes a profit.

Although, the Chime mobile banking app is freely accessible. Customers can utilize the services merely by installing the app. But it earns in the form of fees. So, you can say it makes money through indirect sources.

- Chime charges interchange fees to each of its customers. It is the processing fee on the purchase of goods or services. Thus, merchants need to pay fees to Chime on every transaction of consumers.

- The ATM network of Chime is among the broadest in the USA. However, the ATM fee is charged if the user needs to withdraw from outside the network. It is nearly $2.50 to $3.50 per transaction.

- Now, Chime also makes money through interest on deposits. It offers secure deposit accounts to customers. Furthermore, it uses that money to lend loans to customers. Consequently, it earns interest on loans as well.

- Lastly, as Chime has tied up with other financial institutions, it serves investment products. Customers can use investment services like mutual funds on Chime. As a result, Chime earns brokerage from those financial institutions.

Moreover, the revenue sources of Chime are numerous. So, your ideal banking app like Chime will definitely make a profit. You need to be consistent and integrate essential features.

Related Guide: Top Mobile Banking Trends

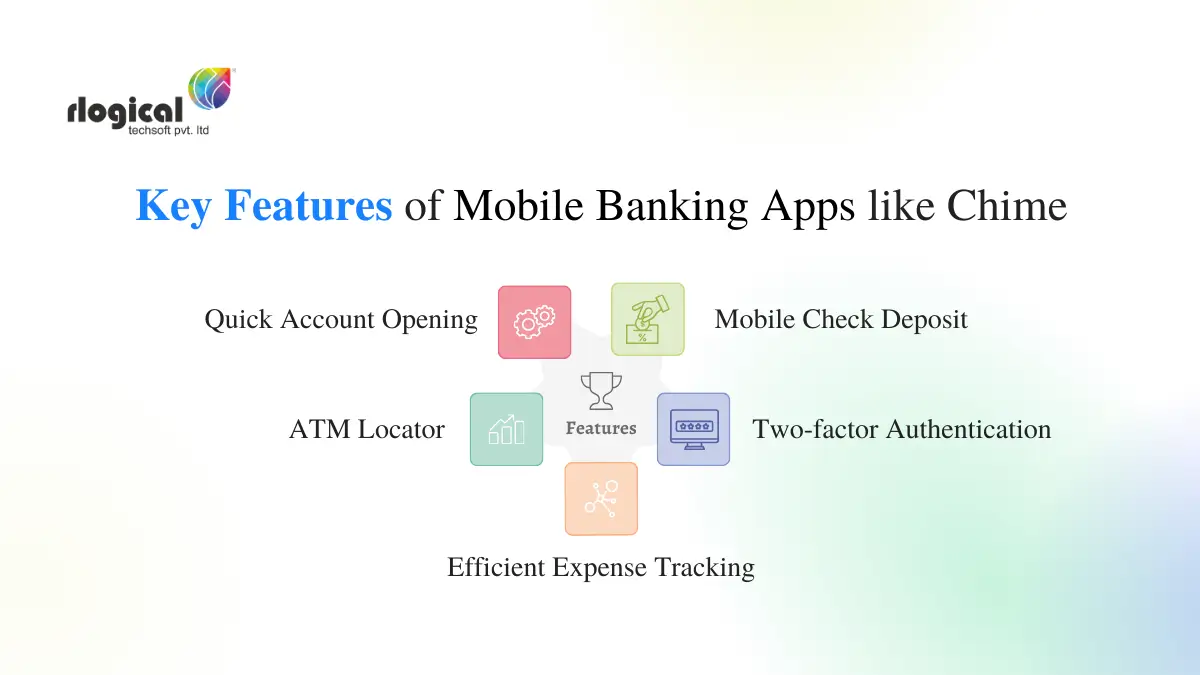

What are the Key Features of Mobile Banking Apps like Chime?

To reap the benefits of developing a banking app like Chime, you need to look for major features. Chime provides user-friendly features. That’s why it has over 10 million downloads. So, here is the list of features inspired by the Chime app.

-

Quick Account Opening

Firstly, leveraging new users to open accounts quickly. It can enhance your application efficiency and simplify the user journey. Hence, users can log in and get started with banking operations. It’s an instant and easy way to organize your finances.

-

Mobile Check Deposit

Secondly, the check deposit feature is a curated measure. So, it permits users to click and upload the check utilizing the mobile app. Sounds crazy? But it’s true. You can simply click the photo of both sides of the check. Resultantly, it will save you time to visit the bank branch.

-

ATM Locator

Delivering apps like Chime, you can also expand in the market with the ATM locator feature. Besides that, it enables your application with a geofencing solution. As a result, it automatically fetches the location of nearby ATMs. So, users will get ATMs conveniently.

-

Two-factor Authentication

Mobile banking apps like Chime prioritize security measures. With two-factor authentication, you can also improve security. However, your banking mobile app should set up two-factor authentication. It implies that the app shouldn’t be unlocked without the correct fingerprint. Consequently, restricting unauthorized person access is the best security measure.

-

Efficient Expense Tracking

Chime offers you a personalized banking experience. Unlike traditional banks, you can benefit customers with an expense-tracking solution. Thus, the Chime banking app tracks your expenses to generate reports.

Offline banking doesn’t offer such a powerful feature. However, it is better defined as the solution to financial planning. As a result, you can determine and achieve realistic financial goals.

How To Develop an Online Banking App Like Chime? – 6 Steps Guide

-

Market Research

Analyzing the market needs and performing research is a critical aspect. Because you need to look into the technology progression, market trends, etc. It will assist you in planning your banking app idea efficiently. Additionally, you can understand your target audience and their behavior.

-

Build an MVP

Today, for any new product success is majorly dependent on the minimum viable product (MVP). Aside from that, developing an MVP supports your idea’s reliability. It allows you to make necessary changes from the results of MVP. So, you can come up with a robust final product.

-

UI/UX Design

The design elements for any application play a critical role. Applications lacking eye-catching UI have increased the abandon rate. Therefore, apps like Chime Bank demand a strategic color scheme, icons, and responsive layout.

With efficient UI/UX, you can swiftly seek the attention of your customers. Have you noticed the Chime app’s design? They have preferred a minimalist approach. Green and white are the color themes. Alongside this, the navigation is also simplified. Furthermore, you should focus on design to offer an optimized user experience.

-

Determine the Technology Stack

The technology stack to create an app like Chime is critical. It is among the significant factors in making your application. Hence, to streamline your task, here is the list of tech stacks.

Before that, you need to finalize the appropriate platform. Android, iOS, web, and others are the major ones, Normally, users look for apps on these platforms. Moreover, based on the selected platform, the technology stack varies.

Programming Languages: Kotlin, Java, Objective-C

Frameworks: Flutter, React Native

Databases: PostgreSQL, MySQL, and MongoDB

Cloud Storage: Google Cloud, Amazon Web Services

Web Server: Nginx, Apache

IDE: Android Studio, Cordova

APIs: Google Analytics API, Firebase

-

Develop your Banking App

Now, you have evaluated the tech, tools, and features for app development. It’s time to execute the plan. However, it also necessitates hiring app developers.

The actual banking app development process is performed with technical excellence. You can outsource the development to an efficient app development agency. We can assist you in minimizing your hassle.

Refer to our blog on how to hire full stack app developers and get started now!

-

Test and Launch the App

Online banking apps like Chime are essential to have a quality check. Therefore, it performs testing to ensure security integration and development process. Additionally, it helps troubleshoot errors is an important aspect.

Only after the green indication on all the parameters, the app is ready to launch. Apart from that, once the app is launched, you need to look for timely maintenance and support.

What would be the Cost to Develop an App like Chime?

The cost to develop apps like Chime Bank is what you should consider a priority. Well, the average cost would range between $20,000 to $25,000. However, you should also look for the major factors such as;

- Features of app

- Technology Stack

- Location of App developers

- Third-party integrations

- Selection of Platforms

- Security Compliance

Accordingly, the cost also increases with the addition of extra features. So, it is necessary to make the right choices well in advance.

Pro tip: Consider hiring mobile app developers from India. The hourly rate in India better fits your startup budget.

4 Advanced Features to Create an App Better than Chime

To develop a banking app like Chime, you can make a sufficient presence with the above features. But to get a competitive edge, you need to think out of the box. The best way to do so is to create a banking app with reforming solutions. Let’s have a look at them.

1) Cardless ATM withdrawal

Cardless or contactless ATM withdrawal is a proficient feature. It allows you to have rapid access to withdrawal. So, you can use your application to withdraw money. It eliminates the need for physical cards. Allowing users to seamless ATM withdrawals gains their loyalty. Hence, your app keeps users enraged to use your service frequently.

2) Voice Assistant

Offering voice-activated banking is another significant solution. It builds the unique presence of your app among users. Thus, you can transfer money and handle bill payments. It secures your application with your voice. Particularly, for physically disabled people, voice assistants will make banking operations hands-free.

3) Push Notification

Adding push notifications is a great way to manage the account for users. It sends notifications in the form of alerts. These alerts are related to the account balance, transaction history, specific payment reminders, etc. It delivers a personalized experience to customers. So, you should emphasize such effective features as well.

4) QR Code Payments

Your banking app like Chime will get the QR code to identify your card details. It helps you to receive and make payments easily. You no longer need to fill in the card details. Through scanning the QR code, the merchant can fetch the details and perform the transaction. Therefore, it is a good way to boost quick accessibility.

Key Takeaways — Build A Banking App Like Chime With Rlogical!

Even after this wholesome guide, you must have other questions. Remember that creating an app like Chime has never been a cakewalk thing. You need to analyze and oversee each stage thoroughly. However, Rlogical Techsoft can get you through the straightforward pathway. Our experts have an edge in making feature-rich applications. Your mobile banking app will get industry-oriented solutions. Take a step forward and see how your project will succeed!

FAQs

1) Which are the other Top Banking Apps like Chime?

The topmost pioneering competitors of Chime are;

- Ally

- Capital One 360

- Wells Fargo

- Bank of America

- Varo

- Discover Bank, etc.

2) How to Develop a Banking App in 2024?

Developing a mobile banking app requires understanding various aspects. You can check out our whole expert guide on the same. Click here

3) What would be the rewarding Advantages to users from Building an App like Chime?

Advantages to customers from your online banking app like Chime are;

- Remotely accessible banking services

- Easy account management solution

- Optimum security and scalability

- Instant fraud detection

- Customized user experience

- Technology-driven banking operations

- Eliminate the need for physical branch visit

Thus, you can establish a global customer base from your mobile banking app.

4) What would be the Timeframe for Creating an app like Chime?

Usually, you can get your banking app ready within 5-7 months. Furthermore, the time span can increase based on your project requirements.

Rahul Panchal

Rahul Panchal is the Founder & Managing Director at Rlogical Techsoft Pvt. Ltd. He is a pioneer tech enthusiast who has assisted diverse enterprise solutions with a fresh perspective over the years. From integrating technologies like Full-Stack, .NET, Flutter & PHP, he has harnessed custom web or hybrid mobile app development projects. His creative outlook on the latest models of AI, ML, blockchain, and IoT, has made various businesses attain leading-edge success.

Related Blog

- Mobile Banking Application Development in 2024: A Complete Expert Guide

- Mint is closing: Develop a Budgeting App like Mint to Attract Gen Z Users

- What is the Cost to Develop an App Like Chase - Business Model & Tech Stack

- A Guide To Understanding Fintech Software Development

- How to Build a Buy Now Pay Later App Like Klarna?

Categories

- All

- Amazon Web Services (AWS)

- ASP.Net Development

- Azure Web App

- Big Data Analytic

- Customize

- Digital Marketing

- Drupal Development

- E-commerce web development

- Education Mobile App Development

- Enterprise Application

- Event Management App Development

- Fintech

- Fitness App Development

- Food Delievery

- Front-End Development

- Healthcare App Development

- Hire Dedicated Developers

- Hotel Booking App

- IT Industry

- JavaScript Development

- Mobile App Development

- On Demand App Development

- On Demand Healthcare App Development

- PHP Development

- POS Software Development

- Real Estate Mobile App Development

- Retail Business App Development

- Salesforce

- Social Media Development

- Software Development

- Technology

- Transportation App Development

- UI/UX Design

- Web Design

- Web Development

- Web Services

- Web/Data Scraping Services

- WordPress

Rahul Panchal in Fintech

Rahul Panchal in Fintech